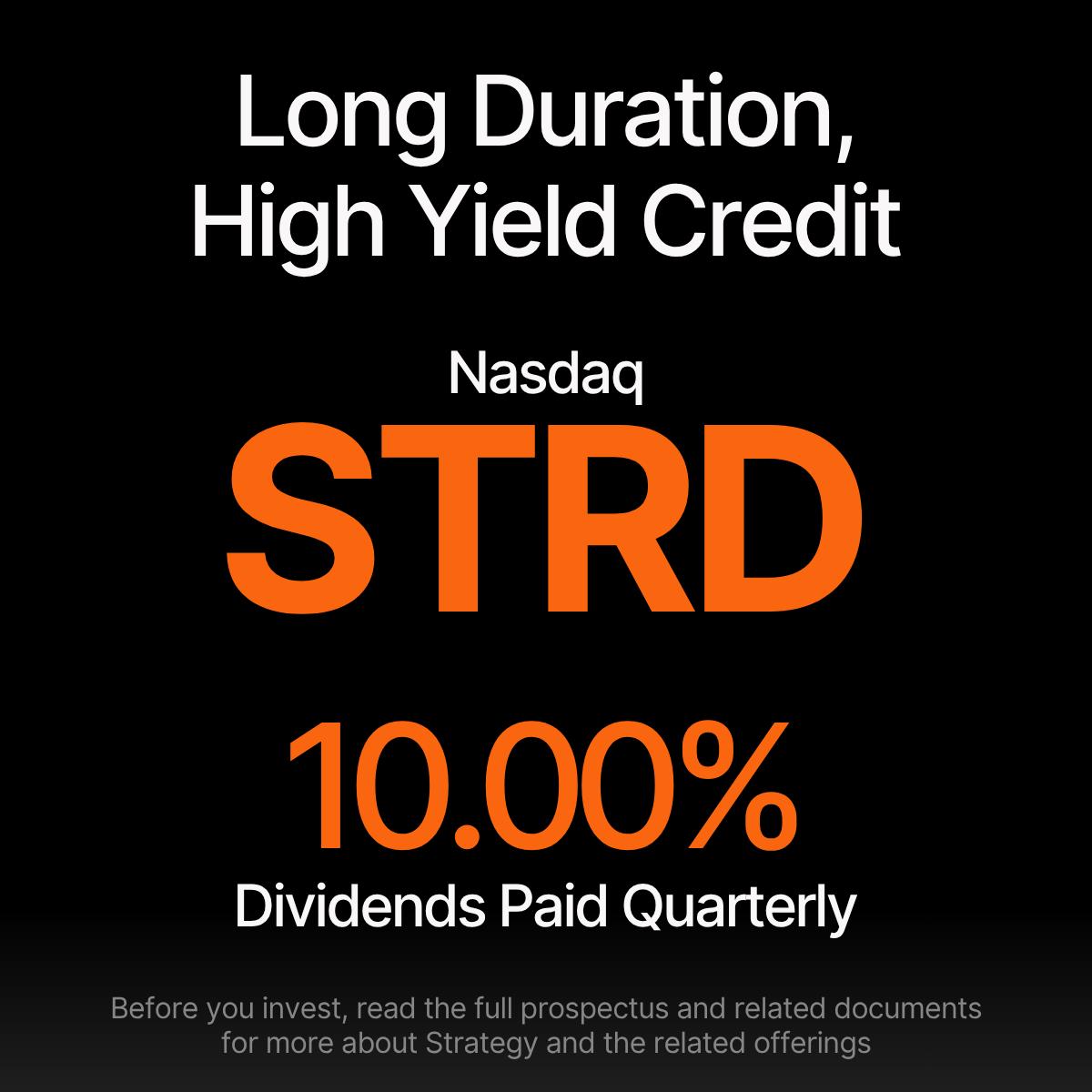

STRD – Long Duration High Yield Credit

Stride (STRD) is Strategy’s perpetual preferred stock with the highest effective yield. STRD offers 10% annual dividends, payable quarterly. Listed on Nasdaq, STRD is available on most major brokerage platforms.

Price

Dividend (Fixed)

10.00%

Effective Yield

Notional ($M)

$1,402.4

Next Record Date

3/15/2026

Next Payout Date

3/31/2026

Avg Trading Vol (30D) ($M)

Hist Volatility (30D)

BTC Rating

Securities market data last updated: -- ET. +/- data reflects change since prior market close (4:00pm ET) for securities market data.

Market data source: Massive.com • See Notes (strategy.com/notes) for important information.

There is no guarantee for STRD of returns, liquidity, or future performance. Cash dividend is not guaranteed.

BTC Rating does not account for potential cross-defaults under our debt obligations. BTC Rating does not represent a rating from any rating agency and is not equivalent to a "rating" in the traditional financial context. BTC Rating also does not account for potential cross-defaults under our debt obligations that would result in debt obligations with stated maturities later than the liability being rated becoming due sooner than the liability being rated. This metric is presented for illustrative purposes only and should not form the basis for an investment decision.

The Company’s preferred securities (STRF, STRC, STRE, STRK, STRD) are not collateralized by the Company’s bitcoin holdings and only have a preferred claim on the residual assets of the company.

The material on this site is provided for illustrative purposes only; and nothing on this site should be construed as a recommendation to buy, sell or hold MSTR, STRD, STRK, STRE, STRC, STRF, or any security or other investment or pursue any investment style or strategy.

Past performance is not indicative of future results. No representation is being made that any investment will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.